Introduction

Did you know that 81% of millionaires have multiple streams of income?

That’s a lot of people who aren’t just relying on their 9-to-5! It got me thinking, and hopefully, it’ll spark some ideas for you too.

We’ve all heard the phrase, “Money doesn’t grow on trees,” right? But what if we could make our money work a bit harder, almost like it does? Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Ouch, right? But he’s not wrong.

So, where does this extra income come from? A good portion of it comes from passive income. Think of it as money you earn with minimal ongoing effort. Now, before you start picturing stacks of cash magically appearing in your bank account, let’s get real—passive income isn’t some “get rich overnight” scheme. But it is one of the smartest ways to build long-term financial security without constantly trading your time for money.

In this guide, we’ll explore the world of passive income together. We’ll break down the common myths, address the challenges, and show you practical steps to start building your own passive income streams.

Understanding Passive Income

What is Passive Income?

passive income definition is earnings that are generated with minimal ongoing effort. This type of income allows you to earn money without directly trading your time for it. Think of it as money working for you, rather than the other way around. Passive income can be earned through various means, such as investments, rental properties, or online businesses. The key characteristic of passive income is that it can generate income without requiring your constant presence or direct involvement.

Active vs. Passive Income: Key Differences

To understand passive income better, let’s contrast it with active income. Active income is earned through direct involvement, such as working a 9-to-5 job or freelance. You’re actively working; you’re trading your time and skills for money. In contrast, passive income is generated through indirect involvement, such as investing in stocks or real estate. With passive income, you’re not directly trading your time for money, but instead, you’re leveraging assets or systems to generate revenue.

Here’s a comparison table highlighting the key differences

| Characteristics | Active Income | Passive Income |

| Time Requirement | Directly trades time for money | Minimal ongoing effort required |

| Income Generation | Earned through direct involvement | Earned through indirect involvement |

| Scalability | Limited by time and energy | Can be scaled up with minimal additional effort |

| Financial Security | Dependent on continuous work | Provides financial security through ongoing revenue |

| Flexibility | Tied to a specific schedule or job | Offers flexibility and freedom to pursue other interests |

| Growth Potential | Limited by individual capacity | Can grow exponentially with the right systems and strategies |

Benefits of Passive Income

So, why is passive income so important? Here are some benefits:

Financial Freedom

Passive income provides the means to pursue your passions without being tied to a specific salary or income source. Imagine being able to travel, pursue hobbies, or start a business without worrying about money. Passive income can give you the financial freedom to live life on your own terms.

Time Flexibility

With passive income, you can allocate your time as you see fit, rather than being bound to a traditional 9-to-5 schedule. Want to spend more time with family, focus on personal growth, or pursue a side hustle? Passive income can give you the time flexibility to do so.

Diversified Income Streams

Passive income allows you to spread your financial risk across multiple income sources, reducing dependence on a single income stream. This can provide a sense of security and stability, knowing that you have multiple revenue streams to fall back on.

Building Valuable Online Platforms

Creating passive income streams can also lead to building valuable online platforms, such as blogs, YouTube channels, job board software or online courses. These platforms can not only generate passive income but also provide a means to share your expertise, connect with others, and build a community.

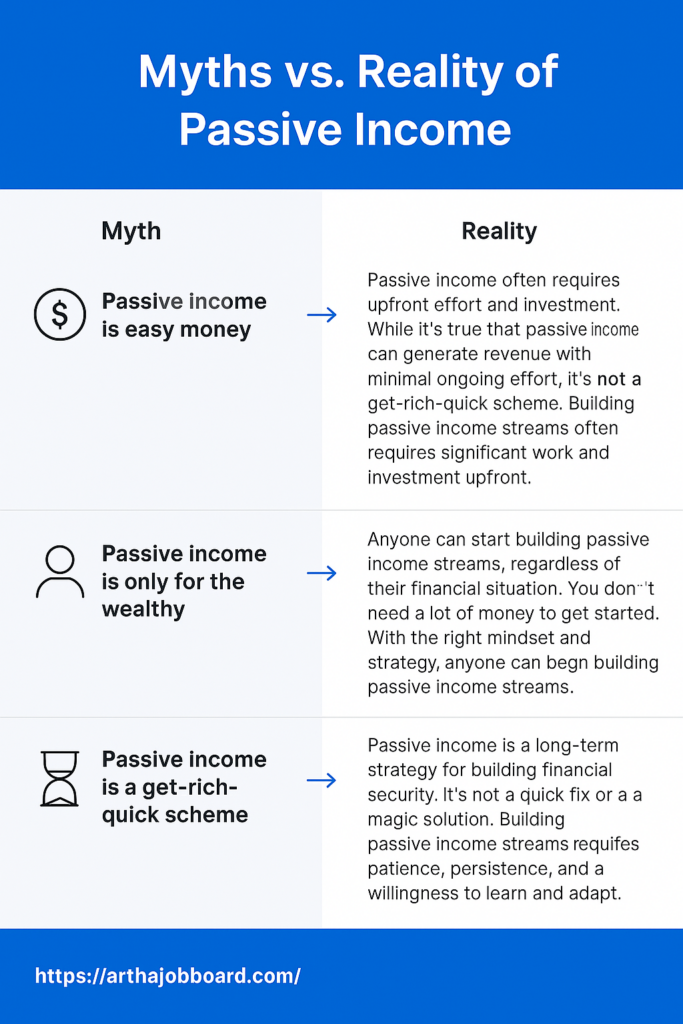

Debunking Common Myths about Passive Income

Before we dive deeper into the world of passive income, let’s address some common myths:

Proven Passive Income Strategies

Now that we’ve covered the fundamentals of passive income, let’s dive into real, proven ways to make it happen. These strategies aren’t just theories—they’ve helped countless people create sustainable income streams. Some require upfront effort, while others need some capital. However, once set up, they can generate income with minimal ongoing work.

1. Digital Products

What It Is

Digital products are downloadable or online assets that people can buy without having to physically ship anything. Think ebooks, online courses, templates, printables, and stock music.

How It Works

- Identify a need: What problems do people have that you can solve? Maybe it’s a beginner’s guide to coding or a set of social media templates for small businesses.

- Create the product: Use platforms like Canva (for design templates), Teachable (for courses), or Gumroad (for digital downloads).

- Market it: Leverage social media, SEO, or even affiliate partnerships to drive traffic and sales.

- Let it sell on autopilot: Once set up, digital products can sell without any extra work from you.

Why It Works

Unlike a physical business, digital products don’t require inventory, shipping, or restocking. You create it once and sell it again and again.

Have a look at this medium article to better understand how to earn money selling digital products: How I Make Passive Income Selling Digital

2. Affiliate Marketing

What It Is: Affiliate marketing is when you promote someone else’s product or service and earn a commission for every sale made through your referral link.

How It Works

- Choose a niche: Tech, fitness, finance, education—pick a topic with high demand and valuable products.

- Find affiliate programs: Join networks like Amazon Associates, ShareASale, or Impact.

- Create valuable content: Use blogs, YouTube, social media, or email marketing to drive traffic to your affiliate links.

- Earn passive commissions: Once your content ranks on Google or gains traction, commissions keep rolling in without additional effort.

Why It Works

If done right, affiliate links can generate income for years as long as people continue searching for the content you’ve created.

3. Real Estate Investing

What It Is

Real estate investing allows you to earn money through rental properties, real estate investment trusts (REITs), or crowdfunding.

How It Works

- Buy and rent properties: Invest in properties that generate rental income, or join real estate crowdfunding platforms like Fundrise.

- Invest in REITs: REITs let you invest in real estate without owning property—they pay dividends like stocks.

- Appreciation: Over time, real estate usually gains value, increasing your wealth.

Pros

- Steady cash flow from rental income

- Long-term appreciation increases wealth

Cons

- Requires upfront capital or good credit

- Market fluctuations can impact value

Also Read: How to Maximize Your Revenue

4. Dividend Investing

What It Is

Dividend stocks are shares of companies that pay out a portion of their profits to investors. It’s one of the easiest ways to earn passive income without selling anything.

How It Works

- Pick dividend-paying stocks: Companies like Coca-Cola, Apple, and Johnson & Johnson regularly pay dividends.

- Build a diversified portfolio: Invest in a mix of industries to spread risk.

- Reinvest dividends: Instead of cashing out, use dividends to buy more stocks, leading to compound growth.

Why It Works

Over time, dividend payments can become a stable income stream, requiring no effort beyond initial investment.

Want to know how Dividend Investing works? Watch this video to find out in detail.

5. Creating Online Courses & Memberships

What It Is

If you’re good at something, why not teach it online? Online courses and memberships, with proper monetization, pay you repeatedly and are easy to manage

How It Works:

- Choose your topic: What do people constantly ask for help with?

- Create the content: Use platforms like Teachable, Udemy, or Kajabi to host your course.

- Build a community: Offer exclusive content, live Q&As, or bonus material for paid members.

- Sell once, earn forever: As long as people enroll, you keep making money.

Why It Works

Unlike one-time products, memberships and courses provide recurring revenue, ensuring long-term income.

6. Selling Digital Art & Photography

What It Is

If you’re a photographer, artist, or designer, you can sell your work online repeatedly without printing or shipping anything.

How It Works

- List your work on marketplaces: Try Etsy, Adobe Stock, Shutterstock, or Redbubble.

- License your digital assets: Companies pay to use your work for commercial projects.

- Earn passive royalties: Every time someone downloads or buys your art, you get paid.

Why It Works

Once uploaded, digital assets keep selling for years, creating a truly passive revenue stream.

7. Building an Online Business

What It Is

Instead of trading time for money, build an online business that runs without constant effort.

How It Works

- Find a scalable business model: Dropshipping, print-on-demand, or automated services.

- Outsource tasks: Hire freelancers or use AI tools to handle customer service, marketing, or content creation.

- Create automated sales funnels: Set up email sequences, ads, or SEO-driven content that converts visitors into customers without daily involvement.

Why It Works

Once the system is in place, the business operates with minimal hands-on work, generating income passively.

8. Creating a YouTube Channel

What It Is

YouTube pays creators through ad revenue, sponsorships, and memberships.

How It Works

- Choose a niche: Tutorials, reviews, gaming, finance—pick a category with demand.

- Monetize your content: YouTube ads, brand deals, affiliate links, and fan memberships.

- Scale and automate: As old videos gain views, they keep making money.

Why It Works

Even years-old videos can still generate ad revenue, making YouTube a powerful passive income stream.

9. Building a Niche Job Board

What It Is

Job boards connect employers with job seekers. By targeting a specific niche, you can create a highly profitable platform.

How It Works

- Identifying a Profitable Niche: Find a niche with a strong demand for talent and limited competition. This could be a specific industry, skill set, or geographic location.

- Platform Selection and Setup: Choose a white-label job board software that fits your needs and budget—without the hassle of building it from scratch, like Artha. Look for a platform that offers ease of use, customization options, and monetization features. Most importantly, prioritize one that’s free to launch, so you can get started with zero upfront investment.

- Monetization Strategies: Offer premium job listings for increased visibility, or create subscription packages for employers who frequently hire within your niche. Explore ad revenue as well.

- Community Building and Engagement: Create a community around your job board by offering valuable resources, hosting events, and fostering interaction between employers and job seekers.

Getting Started with Passive Income

Setting Realistic Goals

Earning passive income will take time; don’t expect to become a millionaire overnight. Start with achievable goals, like generating an extra $500 per month. Break down your larger financial aspirations into smaller, manageable steps. This approach keeps you motivated and provides a clear roadmap for your progress. Remember, consistency beats intensity in the long run.

Assessing Your Skills and Resources

What are you good at? What resources do you already have? Leverage your existing skills and knowledge to identify potential passive income streams. If you’re a writer, consider ebooks. If you’re a programmer, think about creating digital tools. Assess your financial resources, time availability, and network connections. Building passive income is about maximizing what you already have.

Choosing the Right Strategy for You

There’s no one-size-fits-all approach. Consider your interests, skills, and risk tolerance. If you’re passionate about a specific industry or niche, building a job board could be a perfect fit. It allows you to create a valuable resource for your community while generating revenue. If you prefer a more hands-off approach, dividend investing or affiliate marketing might be better suited. Research different strategies, weigh their pros and cons, and choose the ones that align with your personal goals.

Creating a Plan of Action

Don’t just dream, plan! Outline the steps you need to take to implement your chosen strategy. Set deadlines, create a budget, and track your progress. A well-defined plan will keep you focused and accountable. Break down large tasks into smaller, actionable steps. For example, if you are building a job board, set milestones for platform selection, niche research, monetization strategy, and marketing.

The Importance of Patience and Consistency

Passive income takes time to build. Don’t get discouraged if you don’t see immediate results. Stay consistent with your efforts, learn from your mistakes, and adapt your strategy as needed. Building a sustainable passive income stream is a marathon, not a sprint.

Common Challenges and How to Overcome Them

Time Investment vs. Initial Returns

Many passive income strategies require significant upfront time investment before generating substantial returns. Be prepared to put in the work upfront, knowing that the payoff will come later. Focus on building systems that automate processes and minimize ongoing effort. Remember, the initial time investment is building a foundation for long-term income.

Maintaining Motivation

Building passive income can be a long and sometimes lonely journey. Set small, achievable goals to stay motivated. Celebrate your successes, no matter how small. Find a community of like-minded individuals for support and inspiration. Remember why you started, and visualize your desired outcome.

Dealing with Setbacks, Including Platform Management Challenges:

Setbacks are inevitable. Don’t let them derail your progress. Learn from your mistakes, adapt your strategy, and keep moving forward. If you’re building a job board, you might face challenges with attracting employers or job seekers. Develop a plan for addressing these challenges, such as targeted marketing campaigns or community outreach. Remember, resilience is key.

Staying Up-to-Date with Trends

The landscape of passive income is constantly evolving. Stay informed about new technologies, strategies, and regulations. Follow industry blogs, attend webinars, and network with other passive income enthusiasts. Continuous learning is essential for long-term success.

Legal and Tax Considerations

Passive income is still income, and it’s subject to taxation. Understand the tax implications of your chosen strategies, including platform-based income from job boards or online courses. Keep accurate records of your income and expenses, and consult with a tax professional to ensure compliance.

Legal Requirements for Different Income Streams

Different passive income strategies may have specific legal requirements. For example, real estate investing may require licenses and permits. Online businesses may need to comply with data privacy regulations. Research the legal requirements for your chosen strategies and consult with a legal professional as needed.

Consulting with Professionals

Don’t hesitate to seek professional advice. Consult with tax advisors, financial planners, and legal professionals to ensure you’re making informed decisions. Professional guidance can save you time, money, and potential headaches.

Real-Life Success Story: How Pat Flynn Built a Million-Dollar Passive Income Empire

When it comes to passive income, Pat Flynn is one of the best-known success stories. But he didn’t start off as an entrepreneur—his journey began with an unexpected job loss that forced him to rethink his career path.

How It All Started

In 2008, Pat was working as an architect when the recession hit, and he was suddenly laid off. Instead of jumping straight into another job, he decided to try something different.

He had been studying for the LEED (Leadership in Energy and Environmental Design) exam, and along the way, he had created a small blog to keep track of his notes. Surprisingly, the site started attracting visitors—other people who were also preparing for the exam.

That’s when he had a lightbulb moment: What if he turned his knowledge into a product?

The Passive Income Breakthrough

Pat took all his study notes, organized them into an ebook, and put it up for sale on his website.

Within the first month, he made $7,906—more than his old monthly salary! And since it was a digital product, it kept selling without any extra work from him.

Encouraged by this success, Pat started exploring other passive income streams:

- Affiliate Marketing: He started promoting useful products and tools on his blog, earning commissions whenever someone purchased through his links.

- Online Courses & Memberships: He later expanded his business by launching online courses teaching others how to build passive income streams.

- Podcast & YouTube: He built a personal brand through podcasts and videos, monetizing them through sponsorships and ads.

Where He Is Now

Pat Flynn went from being laid off to building Smart Passive Income (SPI), a multi-million dollar business that runs largely on passive income streams. His website, podcast, and online courses have helped thousands of people build their own sources of income.

Conclusion

Passive income isn’t just a buzzword—it’s a proven way to achieve financial stability and long-term security. While it may not be “easy money,” the effort you put in today can create a steady revenue stream for years to come. Whether it’s through investments, digital products, real estate, or online businesses, there are countless ways to build income streams that work for you.

The key takeaway? Start now. You don’t need a massive investment or expert-level knowledge to begin. Choose a strategy that aligns with your skills and interests, take small but consistent steps, and refine your approach as you go.

At the end of the day, financial freedom isn’t just about making more money—it’s about creating options, flexibility, and the ability to live life on your own terms. So, whether you’re looking to supplement your income, escape the paycheck-to-paycheck cycle, or build a legacy, passive income can be the game-changer you’ve been searching for.

The best time to start? Right now.