Introduction

Picture this: You wake up, grab your phone, and instead of a million work emails, you see payment alerts. While you were asleep, your income kept growing. No extra effort, no chasing clients, just steady cash flow. Sounds good, right?

This is the power of passive income sources—earning money with minimal ongoing effort. Because let’s be real, putting all your eggs in one traditional 9-to-5 basket is kinda risky. That’s where the strategic development of passive income sources becomes essential. It’s about building a robust financial foundation that provides security and empowers you to pursue your passions.

Whether you’re looking to escape the 9-to-5 grind, build financial security, or simply add an extra revenue stream, passive income is the ultimate wealth-building strategy. In this guide, we’re going to break down some awesome ways to make passive income. Ready to make your money work for you? Let’s dive in and find some passive income ideas that fit your style!

What is Passive Income? (And Why You Need It)

Passive income sources are basically money you earn without constantly trading your time. Think of it like planting a money tree. You put in the work upfront, and then it keeps giving you ‘fruit’ (money!) later on. It’s like getting paid royalties for a song, or rent for a house—money coming in, even when you’re not actively working.

Active Income vs. Passive Income: What’s the Difference?

So, you know your 9-to-5? That’s active income. You work, you get paid. Passive income is different. It’s about building a system that makes money for you. Imagine you write an e-book once, and it sells over and over again online. Or you invest in stocks that pay dividends, and the money just shows up. The key is setting up that system, then letting it do its thing.

The Power of Multiple Income Streams

Even if you love your job, having more than one way to make money is smart. Job security isn’t guaranteed, and unforeseen events—like layoffs or industry downturns—can disrupt your finances overnight.

By creating multiple passive income sources, you:

- Reduce financial stress by diversifying income streams.

- Create stability beyond a single paycheck.

- Achieve financial freedom faster.

Many successful professionals don’t just rely on one source of income—they invest in side ventures like real estate, online businesses, or automated platforms like job boards to keep money flowing.

Myth-Busting: Is Passive Income Really 100% Hands-Off

Here’s the real talk: ‘Passive’ doesn’t mean ‘zero effort.’ You’ll need to put in some work upfront to set things up, and you’ll likely need to do some maintenance along the way. But the idea is that you’re not constantly trading hours for dollars. It’s more like tending a garden—you plant the seeds, water it now and then, and then you get to enjoy the harvest. It’s about creating a system that works for you in the long term, not about finding a magic money button.

Best Passive Income Sources to Build Wealth

Building passive income is not just about earning extra cash—it’s about creating long-term financial security. With the right income streams, you can generate money without trading hours for dollars, giving you the freedom to focus on your passions, travel, or even grow other businesses. The key is to find scalable and automated revenue sources that require minimal effort once established. Let’s have a look at the best passive income sources:

1. Launching Your Own Job Board with Artha (Seriously, It’s a Goldmine!)

Why a Job Board?

Let’s face it, jobs are always in demand. Globally, a staggering 435 million people are actively looking for employment. That’s a massive pool of potential users for a well-placed job board. And, the Bureau of Labor Statistics reported 7.7 million job openings in January 2025. This shows that businesses are constantly seeking talent, and your platform can be the perfect bridge.

Imagine being the go-to person for a specific industry or location. You get to connect people with their dream jobs and get paid for it. Pretty cool, right? It’s all about creating a win-win situation.

Job boards are a great way to generate passive income. Once you set it up, it has the potential to generate revenue for a long time. You are entering a market that has constant need and demand.

How Job Board Work As The Best Passive Income Sources

Once you set up your job board, it can basically run itself. With a job board, you don’t have to hire employees or manage products—you simply create a platform where job seekers and employers connect. Once set up, it becomes a self-sustaining ecosystem, requiring minimal intervention while continuously bringing in revenue.

The best part? You can monetize your job board in multiple ways, ensuring consistent cash flow:

- Job Postings: Companies pay to list their openings, generating recurring income.

- Premium Listings: Businesses can pay extra to boost their job visibility, increasing applications.

- Memberships & Subscriptions: Offer exclusive job-matching tools or resume visibility features for a monthly fee.

- Sponsored Ads & Partnerships: Generate advertising revenue from companies that want to market their brand.

With these Income streams, a job board can become a long-term asset, generating income 24/7 without constant management.

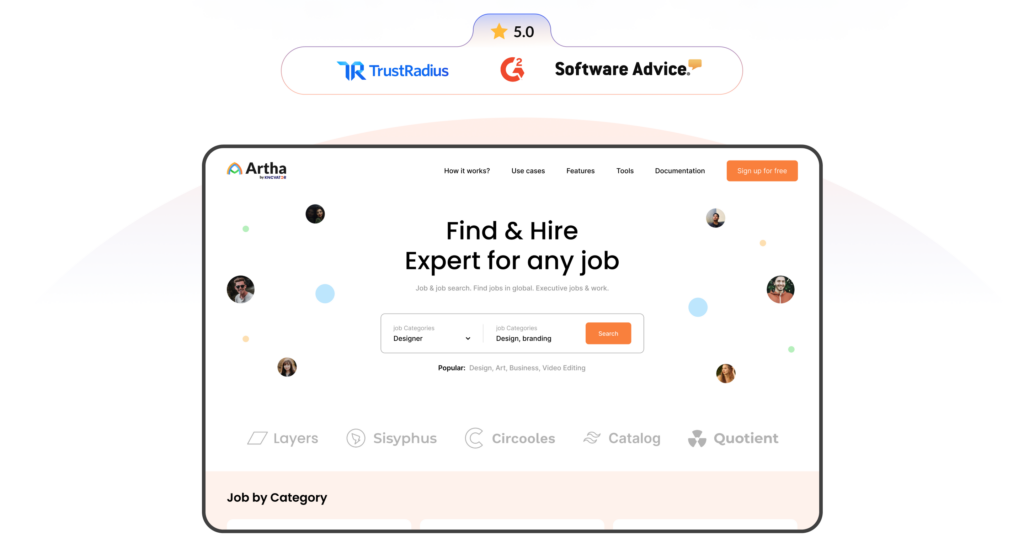

How Artha Makes It Easy

Creating a job board from scratch is time-consuming and technically complex, often requiring development skills, hosting, and ongoing maintenance. This is where Artha simplifies the entire process, allowing you to launch and scale your job board without coding or technical expertise.

- No Coding Required: Anyone can start a job board without needing web development experience. The platform provides an easy-to-use interface to get your site up and running quickly.

- Multiple Revenue Models: Choose from subscriptions, pay-per-post, premium listings, and ad placements to diversify your earnings.

- Automated Operations: Once your job board is live, businesses and job seekers will keep it running, like Smart backfilling, AI job recommendations and other intelligent features that require little day-to-day management.

- Niche Market Customization: Instead of competing with massive job sites, target specific industries (e.g., remote work, healthcare, finance, tech, hospitality) and attract a highly engaged audience.

With Artha, you can create a fully automated business that works around the clock, helping recruiters and job seekers while making money for you in the process.

Case Study: How Jobshala Built a Thriving Job Board with Artha

Check out Jobsahala, for example. Rajesh used Artha to connect job seekers with employers and saw impressive results. By integrating Artha’s AI-powered job board, they optimized hiring workflows, reduced operational costs, and enhanced candidate engagement.

In just 90 days, they saw a 4279 visitor engaging with the platform and a surge in hiring demand. as detailed in the Jobshala case study.

2. Investing in Dividend Stocks

How Dividend-Paying Stocks Work

Okay, so imagine you buy a piece of a company. When that company makes a profit, they sometimes decide to share some of that money with their shareholders. That’s a dividend! It’s like getting a little ‘thank you’ just for owning their stock. It’s a way for companies to reward their investors and a sweet way for you to earn some passive income.

Basically, you invest your money, and then the company sends you regular payments, usually quarterly. It’s not a ‘get rich quick’ thing, but it’s a steady way to build your wealth over time.”

Best Types of Dividend Stocks for Beginners

“If you’re just starting out, you’ll want to look for what we call ‘blue-chip’ stocks. These are companies that have been around for a long time, are financially stable, and have a history of paying consistent dividends. Think big, well-known companies that make products or provide services we use every day. They are seen as more reliable.

Another good option is REITs (Real Estate Investment Trusts). These companies own and operate income-producing real estate, and they’re required to distribute a certain percentage of their income as dividends. It can be a great way to get into real estate without actually buying property.

Real-World Example: How a $1,000 Investment Can Grow Over Time.

Let’s say you invest $1,000 in a company that pays a 4% annual dividend. That’s $40 a year, just for owning the stock. Now, that might not sound like a ton, but here’s the cool part: If you reinvest those dividends, you’re buying more shares, which then pay you even more dividends. It’s like a snowball effect!”

Over time, that significantly, especially if the company also increases its dividend payouts. It’s a smart way to let your money work for you.

For example, if you invest those dividends over 20 years, your initial $1,000 could be worth significantly more, even without adding more money.

Remember, it’s important to do your research and choose reliable companies. But with a little patience and smart investing, dividend stocks can be a great source of passive income.

3. Real Estate Rentals

Buying vs. Renting Properties for Income

So, real estate can be a solid way to bring in that passive income. You’ve got two main paths: buying properties to rent out or even renting out a property you already own. When you buy, you’re the boss, building equity and potentially seeing appreciation over time. Renting out a property you own, can be a great way to make money without having to make a new big purchase. But both methods have their own sets of pros and cons. Buying a property requires a large amount of capital upfront, whereas renting out a property you already own does not.

Short-Term Rentals (Airbnb) vs. Long-Term Leasing

Now, you’ve got short-term rentals, like Airbnb. This can bring in some serious cash, especially in popular tourist areas. But it also means more work: managing bookings, cleaning, and dealing with guests. It’s like running a mini-hotel.

Then there’s long-term leasing, where you rent to tenants for months or years. It’s a steadier, more predictable income stream, but you’ll still have to deal with tenant issues and maintenance. Basically, short-term is high-risk, high-reward, and long-term is lower-risk, steadier-reward. It depends on your lifestyle and how much hands-on work you want.

How to Make Real Estate Passive with Property Managers

Here’s the secret to making real estate truly passive: property managers. These folks handle all the day-to-day stuff: finding tenants, collecting rent, and dealing with repairs. It’s like hiring a team to run your rental business for you.

Sure, they take a cut of your income, but it’s worth it for the peace of mind. You get to enjoy the benefits of real estate without all the headaches. A good property manager can be a game-changer.

This allows you to create a truly passive income stream, where you can focus on other things, while your real estate investments generate income.

4. Selling Digital Products and Online Courses: Earn Passive Income from Your Knowledge

The internet has revolutionized the way people make money, and one of the most scalable passive income sources is selling digital products and online courses. Unlike physical products, digital assets require little to no ongoing effort once created—meaning you can earn money repeatedly from a one-time investment of time and expertise.

If you have skills, knowledge, or experience in a specific field, you can turn that into a profitable digital product. Whether it’s e-books, templates, memberships, or online courses, these digital assets can generate consistent income with minimal maintenance.

Let’s explore how you can create evergreen digital products that keep making money long after they’re launched.

E-Books, Templates, and Memberships: Profitable Digital Products

- E-books: If you have expertise in a particular industry—like recruitment, job hunting, finance, or marketing—you can write and sell an e-book that provides valuable insights, strategies, or guides. For example, an e-book on “How to Land Your Dream Job in 30 Days” could be highly profitable for job seekers.

- Templates & Toolkits: Business owners, freelancers, and job seekers constantly look for ready-to-use templates that save them time. Selling templates such as resume/CV designs, job application email scripts, or HR interview guides can be a highly scalable income stream.

- Membership Communities: Instead of selling a one-time product, you can offer a membership-based model where people pay a monthly or yearly subscription for access to exclusive content, job market insights, or networking opportunities. A private job seeker community with resume reviews, coaching, and career tips could be a great way to generate recurring income.

Why Digital Products Offer Passive, Recurring Income

Unlike services that require continuous effort, digital products are created once and sold indefinitely. Here’s why they’re an ideal passive income source:

- No Inventory or Shipping Costs: Since everything is digital, there are zero production or delivery expenses.

- Automation & Scalability: Once you create a digital product, platforms like Gumroad, Shopify, or Teachable allow you to sell automatically, even while you sleep.

- Global Reach: You can sell to anyone, anywhere, without needing a physical store.

A well-made digital product can bring in consistent sales for years, with little to no ongoing work after the initial setup.

5. Affiliate Marketing

How to Earn Commissions by Recommending Products

Okay, so you know how you tell your friends about a great movie or a cool gadget? Well, what if you got paid every time someone bought that thing because of your recommendation? That’s affiliate marketing! You partner with companies and promote their products, and when someone buys through your special link, you get a commission

Basically, you find products or services you genuinely like, share them with your audience (on your website, blog, social media, etc.), and use special affiliate links. When someone clicks your link and makes a purchase, you earn a percentage of the sale. It’s a simple way to make money by sharing things you love.

Best Platforms: Amazon, ShareASale, and ClickBank

There are tons of platforms where you can find affiliate programs. Amazon Associates is huge, with a massive selection of products. ShareASale and ClickBank are also popular, especially for digital products and services. It’s like having a whole marketplace of things you can promote.

When choosing platforms, look for ones that align with your niche and audience. Do some research to find programs with good commission rates and reliable tracking. It’s like finding the best partners for your business.

How a Job Board Can Also Generate Affiliate Income Through Hiring Tools.

“Here’s a cool twist: Your job board can also be an affiliate marketing goldmine! Think about all the tools and resources job seekers and employers need. You can partner with resume-building platforms, online course providers, and even HR software companies. It’s like adding extra streams of income to your job board.”

“For example, you could promote a premium resume-building service to your job seekers or recommend HR software to companies posting jobs. Every time someone signs up through your affiliate link, you get a commission. It’s like adding value to your users, and getting rewarded for it.”

“This is a great way to provide added value to your job board users, and increase your job boards total earnings.

6. Automated Dropshipping & E-commerce

Setting Up an Online Store Without Holding Inventory

Okay, so you want to sell stuff online, but you don’t want to deal with boxes and shipping? That’s where dropshipping comes in! Basically, you set up an online store, but you don’t actually hold any inventory. When someone buys something from your store, the supplier ships it directly to them. It’s like being a store owner without having a warehouse.

You can sell anything from clothing to electronics to home goods. The key is to find reliable suppliers and choose products that are in demand. It’s like curating your own online boutique, without the upfront investment of buying stock. You focus on marketing and customer service, while the supplier handles the logistics.

Automating Order Fulfillment for Hands-Off Income

Here’s the magic part: You can automate almost the entire process! There are tools and platforms that can handle everything from order processing to shipping notifications. It’s like having a team of robots run your online store for you.

You can use e-commerce platforms like Shopify or WooCommerce and then integrate them with dropshipping apps. This enables you to automate order fulfillment, track shipments, and manage customer communications. This allows you to focus on the marketing side of things and let the software handle the rest.

The goal is to create a system that runs smoothly with minimal input from you. This allows you to generate income without having to constantly monitor your online store. It’s about setting up a digital business that works for you, even when you’re not actively working.

Essentially, you are setting up a system that can generate income with minimal interaction. This is a very useful passive income source.

| Passive Income Source | How It Works | Key Revenue Models | Effort Level |

|---|---|---|---|

| Job Board with Artha | Create a niche job board connecting employers with job seekers. Platform automates listings, payments, and matching. | Job postings, Premium listings, Memberships, Ad revenue | Low (after initial setup) |

| Dividend Stocks | Invest in companies that pay quarterly/annual dividends just for holding their stock. Reinvest dividends for compounding. | Dividend payouts on shares | Low (after investment) |

| Real Estate Rentals | Buy/rent property and let tenants pay rent. Use property managers to automate and minimize direct involvement. | Short-term (Airbnb), Long-term leases, Real estate appreciation | Medium (higher if self-managed, lower with manager) |

| Selling Digital Products & Online Courses | Create e-books, templates, or courses; sell via platforms like Gumroad or Teachable. Customers buy/download automatically. | Direct sales, Membership subscriptions | Medium (upfront content creation, low ongoing) |

| Affiliate Marketing | Promote products/services online. Earn commission when people buy through your referral links. | Affiliate commissions (Amazon, ShareASale, ClickBank, HR tools etc.) | Low |

| Automated Dropshipping & E-commerce | Run an online store – process orders automatically; supplier ships directly to customer (no inventory holding). | Retail margin on products | Low-Medium |

Conclusion

The dream of earning money while you sleep isn’t just a fantasy—it’s a real possibility with the right strategy. Whether you choose to launch a job board with Artha, invest in dividend stocks, start an online store, or create a paid membership community, there are countless ways to build passive income that can lead to long-term financial security.

The key to success is taking action. While passive income streams require some effort upfront, once set up, they can generate recurring revenue with minimal maintenance. The best part? You don’t have to pick just one—combining multiple passive income sources can help you achieve financial freedom even faster.

So, which passive income idea excites you the most? Whether you’re looking to diversify your income, quit your 9-to-5, or simply earn extra cash on the side, now is the perfect time to get started.

Want to explore launching your own job board as a passive income stream? Check out Artha’s case study to see how others are doing it!

FAQs

1 What are the best passive income sources creators should consider in 2026?

Top passive income sources include launching a niche job board with platforms like Artha, dividend-paying stocks, real estate rentals, selling digital products or courses, and affiliate marketing. Combining these can create steady, scalable income with minimal daily effort.

2 How can a job board be a strong passive income source?

Once set up, a job board runs itself by connecting employers and job seekers. With Artha, you get access to 4M+ job ads, automated job backfilling and monetization options like pay-per-post and premium listings so your income keeps flowing while you focus on your content.

3 Are passive income sources really “100% hands-free”?

Not exactly. “Passive” doesn’t mean “zero effort.” Most passive income sources need a bit of setup and occasional maintenance. But if you launch your job board from Artha, there is no upfront cost; you just need to share it in your community, and it can keep generating income automatically.

4 Which passive income source is best for beginners?

If you’re new to this, start with something easy to manage—like launching a job board using Artha, investing in dividend stocks, or creating digital downloads. These passive income sources don’t require a huge upfront investment or advanced tech skills, making them great for beginners.

5 How much money can I make from passive income sources?

That depends on the effort, niche, and time you invest initially. For instance, a niche job board can bring in recurring income, while dividend stocks can provide steady quarterly payouts. Some people make a few hundred dollars a month, while others turn it into a full-time income stream.

6 Do I need to quit my job to start building passive income?

Nope! Most people start small on weekends or evenings and scale up once they see results. The beauty of passive income sources is that they can grow alongside your current job until they’re stable enough to stand on their own.