Introduction

Ever feel like your paycheck disappears the moment it hits your account? Bills, rent, groceries—it all adds up so fast that saving or spending on things you actually enjoy feels impossible. You’re not alone. Many people are looking for ways to earn extra income without having to rely solely on their day job.

That’s where a second income or passive income comes in. It’s not just about making more money; it’s about having options. Whether you want to pay off debt, save for a big goal, or simply feel more financially secure, having an additional source of income can make a huge difference. And the best part? You don’t have to quit your full-time job to get started.

In this guide, we’ll walk through how to build a solid second income stream, explore the opportunities, and help you take practical steps towards a more secure financial future, whether you’re looking for a side gig or something more.

What Makes a Good Second Source of Income

So, you’re thinking about adding a second income stream. Great! But not all opportunities are created equal. You want something that fits your lifestyle and helps you reach your goals. Let’s break down what makes a ‘good’ second income.

The Time Factor

First, consider the time commitment versus the potential returns. Do you have a few hours a week, or are you looking for something more flexible? Some side hustles offer quick cash for minimal time, while others require more effort but can generate significantly higher returns. It’s about finding that balance that works for you.

Then, think about passive versus active income. Active income means you’re trading time for money—like freelancing or driving for a ride-sharing service. Passive income, on the other hand, is when you put in the work upfront and then reap the rewards over time, like creating an online course or investing. Both have their merits, and the best choice depends on your preferences and available time.

Scalability

Scalability is another crucial factor. Are you looking for a small side hustle to supplement your income, or do you dream of building a full-time business? Some opportunities have limited growth potential, while others can be scaled up significantly. Understanding your long-term vision will help you choose the right path.

Ultimately, a good second source of income is one that aligns with your time, goals, and lifestyle. It’s about finding that sweet spot where you can earn more without sacrificing everything else. We’ll explore various avenues and strategies to help you discover that perfect fit.

Best Second Income Ideas for Beginners (Low-Investment & Easy to Start)

If you’re new to earning a second income, the best approach is to start with low-investment and flexible opportunities. These side hustles don’t require specialized skills or large upfront costs, making them great for beginners. You can start small, learn as you go, and scale up over time. Here are some easy second income ideas.

1. Freelancing (Writing, Design, Coding, etc.)

Freelancing is one of the fastest and most flexible ways to earn extra income. Whether you’re skilled in writing, graphic design, web development, or social media management, there’s always demand for freelance work.

- Platforms like Upwork, Fiverr, and Freelancer make it easy to connect with clients.

- You set your own rates and schedule.

- Over time, freelancing can turn into a steady income stream or even a full-time career.

2. Online Surveys & Microtasks

If you’re looking for a truly easy and commitment-free way to make extra cash, online surveys and microtasks might be worth a try. These won’t make you rich, but they can provide a steady trickle of extra income without much effort.

- Websites like Swagbucks, Amazon Mechanical Turk, and UserTesting pay for completing small tasks.

- Activities include taking surveys, testing apps, and watching ads.

- It’s something you can do in your spare time—while commuting, waiting in line, or watching TV.

3. Selling Print-on-Demand Products

If you have an eye for design but don’t want to deal with inventory or shipping, print-on-demand (POD) is a great second income option. You create designs, and when someone makes a purchase, a third-party service prints and ships the product for you.

- Platforms like Redbubble, Teespring, and Printful handle fulfillment.

- You can sell t-shirts, mugs, phone cases, stickers, and more.

- Once your designs are up, sales can become a passive income stream.

4. Affiliate Marketing

Affiliate marketing allows you to earn money by promoting other people’s products. Every time someone makes a purchase through your referral link, you get a commission.

- Sign up for affiliate programs like Amazon Associates, ShareASale, or Commission Junction.

- Promote products through a blog, YouTube, social media, or email marketing.

- Once set up, affiliate marketing can become a passive source of income.

5. Finding Gigs & Projects on Job Boards

Job boards aren’t just for full-time job seekers—they’re great for finding side gigs, part-time work, and short-term projects. If you’re looking for flexible ways to earn money, browsing job boards can uncover opportunities in:

- Customer support, virtual assistance, transcription, tutoring, and more.

- Gig economy jobs like delivery driving, pet sitting, or event staffing.

- Remote work opportunities that fit around your schedule.

Pro Tip: If you want to take it a step further, consider starting your own job board. It’s a great business model that lets you earn from job postings, memberships, and ads—turning a side hustle into a scalable business.

Best Second Income Ideas for Professionals (Leveraging Expertise for Higher Pay)

If you already have experience in a specific industry, why not use it to earn extra income? Unlike beginner-friendly side hustles, these second income opportunities allow professionals to charge higher rates, work on flexible terms, and maximize earnings by leveraging their expertise.

1. Consulting & Coaching

If you have years of experience in a field—whether it’s marketing, finance, HR, IT, or business strategy—companies and individuals are willing to pay for your knowledge.

- Consulting: Businesses often need expert advice on improving their processes, increasing sales, or managing teams. You can work with companies on a freelance basis and charge per hour or per project.

- Coaching: If you enjoy mentoring others, coaching in areas like career growth, leadership, fitness, or personal finance can be highly rewarding.

How to Get Started

- Offer your services on job boards, LinkedIn, or freelance platforms like Clarity.fm.

- Build authority by sharing insights through blogs, social media, or webinars.

- Create coaching packages that offer one-on-one or group sessions.

2. Teaching Online (Udemy, Skillshare, etc.)

If you’re skilled in something—whether it’s coding, public speaking, graphic design, or even photography—you can turn your expertise into a passive income source by creating an online course.

- Platforms like Udemy, Skillshare, and Teachable allow you to sell courses to students worldwide.

- Once the course is live, it generates income with little ongoing effort.

- Live workshops and paid webinars are another great way to monetize your knowledge.

3. Real Estate Investing

Real estate is one of the most time-tested ways to build wealth. If you have the capital, investing in rental properties, REITs (Real Estate Investment Trusts), or Airbnb listings can generate a steady second stream of income.

- Rental Properties: Buy property, rent it out, and earn monthly income.

- Flipping Houses: Buy undervalued homes, renovate, and sell at a profit.

- REITs: Invest in real estate without owning property by buying shares in real estate companies.

Pro Tip: If you don’t want to manage properties yourself, consider hiring a property management company to handle tenants and maintenance.

4. Stock Market Trading

If you’re financially savvy, investing in stocks, ETFs, or cryptocurrencies can be a powerful second income stream. It requires market knowledge, but with the right strategy, it can provide consistent returns.

- Dividend Stocks: Earn passive income from stocks that pay regular dividends.

- Swing Trading: Buy and sell stocks based on market trends.

- Long-Term Investing: Build wealth by holding stocks for years and benefiting from capital appreciation.

Risk Factor: While investing has high earning potential, it’s important to have a solid understanding of the market before diving in.

Getting High-Paying Contract Jobs via Job Boards

Not all second incomes have to be “side hustles.” Many professionals earn extra income by taking on short-term contract roles through job boards.

- If you’re a developer, project manager, copywriter, or data analyst, companies often hire professionals for remote, contract-based work.

- Contract jobs allow you to work on your own terms, often with higher hourly rates than full-time roles.

- Many professionals eventually transition to full-time freelancing or consulting after seeing the income potential.

How to Find These Jobs

- Use platforms like VacanciesWithSirnashy, VettedTalent, and industry-specific job boards.

- Keep an eye out for contract and part-time listings on major job sites.

- Network with recruiters and companies that hire contract professionals.

Second Source Of Income Ideas That Can Become Full-Time Careers

A side hustle doesn’t have to stay small forever. Many people start with a second income and, over time, grow it into a full-time business. If you’re looking for something that can scale, these ideas allow you to start small, build gradually, and eventually replace your 9-to-5 job.

1. E-Commerce & Dropshipping

Selling products online is one of the most scalable ways to generate income. Unlike traditional retail, e-commerce businesses don’t require a physical store, and with dropshipping, you don’t even need to handle inventory.

| Second Income Sources | E-commerce stores: Platforms like Shopify, Etsy, and Amazon let you sell products online. You can source your own products or use print-on-demand services.

Dropshipping: You sell products, but suppliers handle inventory and shipping. Low risk, high potential. |

| Why It Works | Once you build a successful store, it can run with minimal effort, allowing you to scale into a full-time business. |

| Real World Example | Super Tan Brothers |

2. Blogging & YouTube Monetization

Content creation is a powerful long-term income stream. Whether through blogging, YouTube, or social media, you can monetize your content and turn it into a full-time career.

| Second Income Sources |

|

| Best For | Those who enjoy writing, making videos, or sharing insights with an audience. |

| Real World Example | Pat Flynn |

3. App Development & Digital Products

If you have tech skills, developing an app or selling digital products can provide highly scalable, passive income.

| Second Income Sources |

|

| Why It Works | Unlike service-based businesses, digital products can be sold indefinitely without extra effort. |

| Real World Example | David Smith |

4. Franchising

Franchising is a great way to start a business with a proven model. Instead of building a brand from scratch, you buy into a successful business framework and operate under its name.

| Second Income Sources |

|

| Best For | Those who want a business but prefer an established system over starting from zero. |

| Real World Example | Ray Kroc – Turning McDonald’s into a Franchise Empire |

Launching & Monetizing a Job Board Business

A job board isn’t just a tool for finding work—it can be a highly profitable online business. If you niche down and focus on a specific industry, you can build a job marketplace that connects companies with talent and generates revenue in multiple ways.

| How a Job Board Makes Money |

|

| Why It Works |

|

| Real World Example | Mary-Esther Anele |

Passive Second Stream of Income Ideas

Passive income is the ultimate goal for many looking for a second income. Unlike active work, these income streams allow you to make money with minimal ongoing effort. While most require some upfront investment—whether in time, money, or skills—they can eventually generate consistent revenue with little maintenance.

1. Rental Income (Airbnb, Real Estate, & More)

Owning rental properties is one of the oldest and most reliable ways to earn passive income.

| Second Income Sources |

|

| Why It Works |

|

| Real World Example | Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, the founders of Airbnb |

2. Dividend Investing

Dividend stocks allow you to earn money without selling your investments. By purchasing shares in companies that pay dividends, you receive a portion of their profits quarterly or annually.

| Second Income Sources |

|

| Why It Works | Dividend investing works by providing a steady, passive income stream through regular payouts while compounding wealth over time |

| Real World Example | Warren Buffett |

3. Writing eBooks & Selling Courses

If you have expertise in a topic, turning your knowledge into a digital product can generate passive income for years.

| Second Income Sources |

|

| Pro Tip | Combine eBooks with blogging or YouTube to drive traffic and sales. |

| Real World Example | Graham Cochrane, the founder of The Recording Revolution. |

4. Royalties from Creative Work

If you have a creative side, royalties can turn your work into ongoing income.

| Second Income Sources |

|

| Why It Works | Create once, and get paid repeatedly whenever someone uses your work. |

| Real World Example | J.K. Rowling, the author of Harry Potter. |

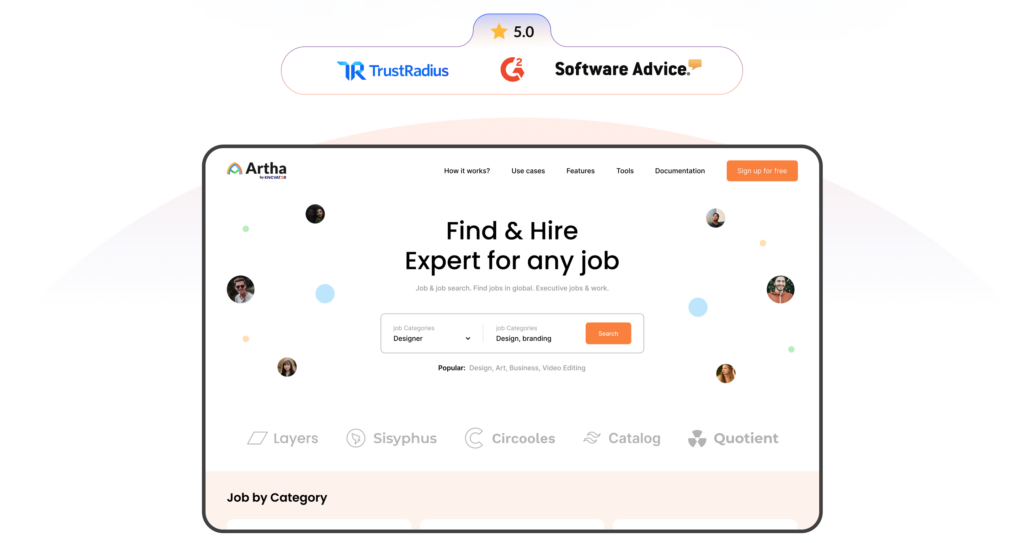

5. Running an Automated Job Board (A Long-Term Passive Income Source)

A job board business is a hidden gem when it comes to passive income. Instead of searching for gigs, you create a platform where others find work—and you get paid in the process.

| Second Income Sources |

|

| Why It Works | Job seekers will always need work, and employers will always need talent—making job boards a recession-proof business. |

| Real World Example | Artha |

Job Boards: A Second Income & A Permanent Business

Job boards aren’t just a tool for finding jobs—they can also be a profitable business venture. If you’re looking for a scalable, long-term second income, launching your own job board can be a smart move. It’s a business that grows over time, generates revenue in multiple ways, and requires minimal ongoing effort once established.

And the best part? Platforms like Artha allow you to launch a job board for free, eliminating the need for an upfront investment. That means zero risk and unlimited earning potential as your platform grows.

1. Why Launch a Job Board

Every industry needs a dedicated space for hiring and recruiting. A niche job board connects employers with the right talent while allowing you to monetize job listings, premium features, and ads. Unlike service-based side hustles, a job board can run with minimal involvement once it gains traction.

Why It’s a Great Second Income:

- Scalable: Can start as a side project and grow into a full-time business.

- Recurring Revenue : Earn consistently through paid job posts and premium features.

- Low Maintenance: Once automated, it requires less daily work compared to other businesses.

- No Initial Investment: With Artha, you can launch a job board for free, making it a risk-free opportunity.

2. How to Monetize Your Job Board

A job board can generate income in multiple ways, making it a flexible and lucrative business model.

- Paid Job Listings: Charge companies to post job openings.

- Featured Listings & Ads: Offer premium visibility for employers.

- Subscription Plans: Provide exclusive access to high-quality job listings.

- Affiliate Partnerships: Partner with career services and earn commissions.

Pro Tip: The more specialized your job board is (e.g., focusing on tech jobs, creative roles, or remote work), the easier it is to attract targeted employers and job seekers.

3. How Platforms Like Artha Make It Easy

Starting a job board usually requires technical knowledge, hosting, and marketing, but Artha simplifies everything.

- Free to Launch – Get started with zero investment.

- Built-in Monetization – Easily charge for job postings, featured listings, and memberships.

- Automated & Scalable – Let the platform handle listings, payments, and job seeker interactions.

By using Artha’s ready-to-go job board solution, you can focus on growing your platform and earning passive income instead of worrying about development costs.

How to Choose the Right Second Income Opportunity

With so many second income ideas available, how do you know which one is right for you? The key is to find a balance between time, earnings potential, and your skills while avoiding scams and unrealistic promises. Here’s how to make the best choice:

1. Evaluating Time vs. Earnings Potential

Not all second income opportunities require the same level of effort or offer the same returns. Some side hustles can bring in quick cash, while others take longer to build but have higher long-term earning potential.

- Low-Time, Low-Income: Online surveys, microtasks, small freelancing gigs.

- Moderate-Time, Moderate-Income: Freelancing, affiliate marketing, selling digital products.

- High-Time, High-Income: E-commerce, real estate investing, launching a job board.

2. Matching Skills & Interests to Side Hustles

Choosing a second income source that aligns with your skills and interests increases your chances of success.

- Are you creative? Try freelance writing, graphic design, or selling print-on-demand products.

- Good with numbers? Look into stock market trading or dividend investing.

- Tech-savvy? Consider app development or running a digital business.

- Love networking? A job board business could be a great fit.

Why It Matters: If you enjoy the work, you’re more likely to stay consistent and turn it into a sustainable income stream.

3. Avoiding Scams & Unrealistic Promises

If something sounds too good to be true, it probably is. Be cautious of:

- “Get rich quick” schemes: True passive income takes effort upfront.

- High upfront fees: You shouldn’t have to pay large sums just to start.

- No clear revenue model: If you’re unsure how you’ll make money, walk away.

Safe Bet: Look for proven opportunities like freelancing, e-commerce, and launching a job board through platforms like Artha, where you can start with zero investment and real earning potential.

Conclusion

Earning a second income isn’t just about making extra money—it’s about creating more financial stability, freedom, and opportunities. Whether you choose a simple side hustle, a scalable business, or a passive income stream, the key is to find something that aligns with your skills, interests, and long-term goals.

If you’re looking for a low-risk, high-reward opportunity, launching a job board can be a smart move. With platforms like Artha, you can start for free, build a profitable business, and create a steady income stream over time.

The best time to start is now. Pick an idea, take action, and start building your second income today!