Introduction

Managing cash flow is one of the most difficult challenges for recruitment companies. Long revenue cycles, late payments, and administrative inefficiencies cause significant financial hardship. It’s not simply an annoying scenario; it can substantially impede your progress. In fact, recent industry research showed that 60% of recruitment agencies are experiencing substantial cash flow challenges as a result of delayed revenue cycles. So, why does this happen, and how can it be prevented?

In this blog, we’ll look at the underlying causes of these cash flow issues and why job boards are the game changers that recruiting companies need to overcome them and integrate the latest hiring trends into their procedures.

Prolonged Revenue Cycles

Let’s start with the core issue—prolonged revenue cycles. According to Staffing Industry Analysts’ (SIA) report, only 27% of recruitment agencies have a consistent monthly revenue stream. This shows that the majority of agencies have erratic payment schedules. This means that the great majority are dealing with irregular payments. Training institutes face similar placement delays and revenue losses, leading to financial strain.

Why? Because recruitment agencies are only paid after a successful placement, which might take weeks or even months.

- Delayed Payments: The hiring process is frequently contingent on client needs and market demand, and as these factors fluctuate, so does your income. This uncertainty creates enormous financial stress since cash flow becomes a guessing game.

- Inconsistent Fund Inflow: You’re left trying to forecast when payments will arrive, which puts additional strain on your operations. And, let’s be honest, the longer the hiring procedure, the longer you’ll have to wait for revenue.

Lack of Immediate Cash Flow

It’s not just about the delayed funds. Thehttps://arthajobboard.com/wp-admin/post.php?vc_action=vc_inline&post_id=26175&post_type=post real concern is that your cash flow can dry up if things don’t go as planned.

- Placement Failures: If a candidate resigns or is terminated shortly after placement, you may not be compensated at all. This can result in an unexpected revenue shortfall, making it even more difficult to maintain continuous cash flow.

- Irregular Income: Administrative inefficiencies and the unpredictable nature of applicant retention can wreak havoc on your earnings. Without consistent payments, your agency struggles to fund expenses and prepare for the future.

Common Cash Flow Challenges

| Challenge | Description |

| Payment Delays | Payment only after successful placement. |

| Client and Market Dependency | Hiring process depends on client needs and market demand. |

| Candidate Resignation/Termination | Loss of payment if the candidate leaves or is fired. |

| Administrative Inefficiencies | Irregular income flow from administrative tasks. |

Recruitment Process Bottlenecks

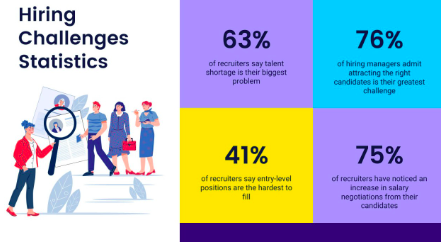

Ever feel like your recruitment process is working against you? You’re not alone. Manual operations can cause serious bottlenecks in your workflows, lengthening the placement period and further delaying revenue.

It takes a lot of time and effort to carry out activities ranging from screening the received candidates to managing other communications.

- Lengthy Hiring Processes: Delays in finding the right candidate.

- High Candidate Turnover: Frequent resignations or terminations.

- Administrative Delays: Inefficiencies in processing candidate placements and payments.

These operational efficiency bottlenecks lead to lengthening of the placement period, which, in turn, hampers the revenue realization cycles as payments become delayed. Therefore, recruitment agencies may experience billing and payment delays leading to an even greater halt in the revenue cycle.

High Administrative Costs

Here’s a further challenge that recruitment agencies face—hefty administrative expenditures. Manual tasks, such as interview scheduling, candidate management, and client coordination, or revenue cycle management can quickly consume your time and resources. The more time you spend on these duties, the higher your operational costs become, and the longer it takes to get paid.

Double-edged sword: These inefficiencies drain both your resources and your time, directly impacting your cash flow. It’s like trying to run uphill with a weight on your back—costly and exhausting.

Inconsistent Client Engagement

The recruitment process doesn’t end at candidate placement—client engagement is key to ensuring smooth transactions and repeat business. Communication delays cause employment choices to take longer, pushing your revenue even further down the line.

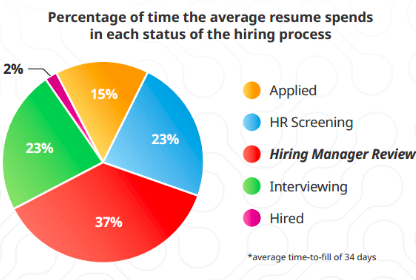

Delays in Decision-Making: The average job vacancy lasts 34 to 42 days, and each day a position remains vacant costs a company about $981. Delays in recruiting decisions caused by uneven customer interaction can have a substantial impact on both the recruitment process and cash flow.

This has caused a lot of agencies to use antiquated, frequently manual follow-up or communication methods, which has a negative impact on customer retention. This inconsistency delays hiring decisions, prolongs the recruitment process, and contributes to cash flow management issues. Real-time communication is essential to ensure clients are engaged throughout the hiring process, minimizing revenue delays.

Also Read: The Secret Behind LinkedIn’s $10 Billion Success Story

Solution: How Job Boards Address These Issues

The solution to these cash flow issues resides in digital transformation—which is where job boards come in.

- Streamlined Workflows: Job boards can help automate recruitment tasks, such as candidate screening and client communication, decreasing manual effort and speeding up the hiring process.

- Access to a Larger Talent Pool: Using a job board eliminates the need to wait for the ideal individual. You get access to a wider pool of talent, which means faster placements and payouts.

- Real-Time Communication: Job boards provide instant communication between candidates, clients, and recruiters, reducing delays and keeping clients interested throughout the process.

- Automated Matching: By automating recruitment tasks or applicant matching, job boards minimize the time it takes to complete placements, allowing you to receive payments more quickly and lowering the risk of revenue delays.

Conclusion

Managing cash flow does not have to be a constant struggle for recruitment agencies. By leveraging job board technology, recruiting companies can streamline time-consuming operations, cut administrative expenses, and improve client engagement—all while reducing their revenue cycle and cash flow challenges.

Ready to gain control of your cash flow and improve your financial performance improvement? Join our exclusive webinar to understand how a custom job board, such as Artha 2.0, can improve your recruitment process and reduce cash flow issues.

Register Now for the Exclusive Artha 2.0 Webinar!

5 FAQ for Recruitment Agencies About Job Boards

Q1: What is revenue cycle training in recruitment?

A: Revenue cycle training focuses on streamlining the income process from candidate placement to final payment collection, helping agencies optimize their cash flow.

Q2: How does a job board helps with delayed payments?

A: It provides agencies with data to make strategies to reduce operational bottlenecks and improve communication, resulting in faster revenue collection.

Q3: How can revenue cycle training improve cash flow?

A: By training agencies to automate key processes and reduce inefficiencies, cash flow is improved through quicker placements and payments.

Q4: What are the main bottlenecks in recruitment agency revenue cycles?

A: Manual candidate screening, outdated communication methods, and high administrative costs are common bottlenecks. Revenue cycle training helps address these issues by automating tasks and improving workflow.

Q5: How much revenue can a job board generate?

A: Revenue depends on your client size and engagement, but a well-monetized job board can increase earnings by 30-40%.